Buy Verified Perfect Money Accounts

Perfect Money provides users with instant, secure transactions on the Internet for instantaneous payments and financial transactions, including instantaneous transfers between U.S. dollars and euros accounts. Perfect Money offers users instant payment services via an online payment system which enables individuals and businesses alike to send and receive funds in various currencies like USD and EUR instantly and safely.

Here are the highlights of Perfect Money:

While various account types (Personal, Business and Premium), each offers different features and benefits, Perfect Money offers three primary account types that all offer similar access: P- B- and Premium accounts with their own benefits for use with Perfect Money:

Currency Options: Users have the flexibility of holding and transacting in multiple currencies such as USD (U.S. dollars), EUR (euros), and more.

Transactions: Perfect Money provides users with instantaneous and secure money transfers between its users, including sending and receiving funds, making online payments, or exchanging currencies within its platform.

Security: Perfect Money prioritises security when conducting its transactions, using various safeguards like account verification and two-factor authentication in order to safeguard its user accounts.

Withdrawal and Deposit Options: Customers may fund their Perfect Money accounts through various methods such as bank transfers, electronic currency transfers and payment systems such as PayPro. Likewise, funds may be withdrawn using various options available to them.

Exchange Services: Perfect Money offers exchange services that enable users to convert one currency to another within its platform. Prepaid Cards: Users of Perfect Money have access to prepaid cards which allow for online and offline purchasing transactions.

Perfect Money offers various services, but users should take caution and thoroughly comprehend its terms and conditions to use responsibly and be aware of potential risks. Furthermore, Perfect Money has become associated with various online businesses including those engaged in e-commerce, investment or digital currency exchange.

Benefits of Buy Verified Perfect Money Account Online

Perfect Money provides multiple advantages to users engaging in financial transactions online. Here are a few key ones:

Global Transactions: Perfect Money offers users global payments without needing traditional banking channels as their means.

Multiple Currency Support: Users have the capability of transacting in various currencies, providing flexibility for individuals and businesses operating globally.

Instant Transfers: Our platform facilitates instant money transfers, enabling users to send and receive funds quickly in time-sensitive situations.

Security Measures: Perfect Money puts an emphasis on security with features like two-factor authentication and account verification designed to safeguard users against unapproved access or fraudulent activities.

Perfect Money offers users a degree of privacy when engaging in transactions, even while employing security measures; users are still free to conduct them without divulging sensitive personal details.

Currency Exchanges: Users can easily exchange one currency for another on our platform, providing users with convenient conversion services that make currency conversion easier than ever.

Prepaid Cards: Perfect Money offers prepaid cards that users can use both online and in-person for shopping purposes, providing an efficient means for spending funds stored in their Perfect Money accounts.

Online Shopping and Payment: Perfect Money can be used for online shopping and payments, making it an indispensable asset to individuals who frequently make purchases online.

Business Transactions: Businesses can utilise Perfect Money for various financial transactions, including payments and invoicing; receiving funds from customers/clients and sending funds back out again to clients/customers.

Access: Our platform is accessible 24/7, giving users a chance to manage and transact at any time – not limited by traditional banking hours or schedules.

Perfect Money offers many advantages for users; however they should remain aware of and exercise caution when engaging any financial platform online. Furthermore, regulatory environments and user experiences vary so it’s imperative that users research the terms and conditions that apply when using Perfect Money in their region.

Verified PerfectMoney For Sale

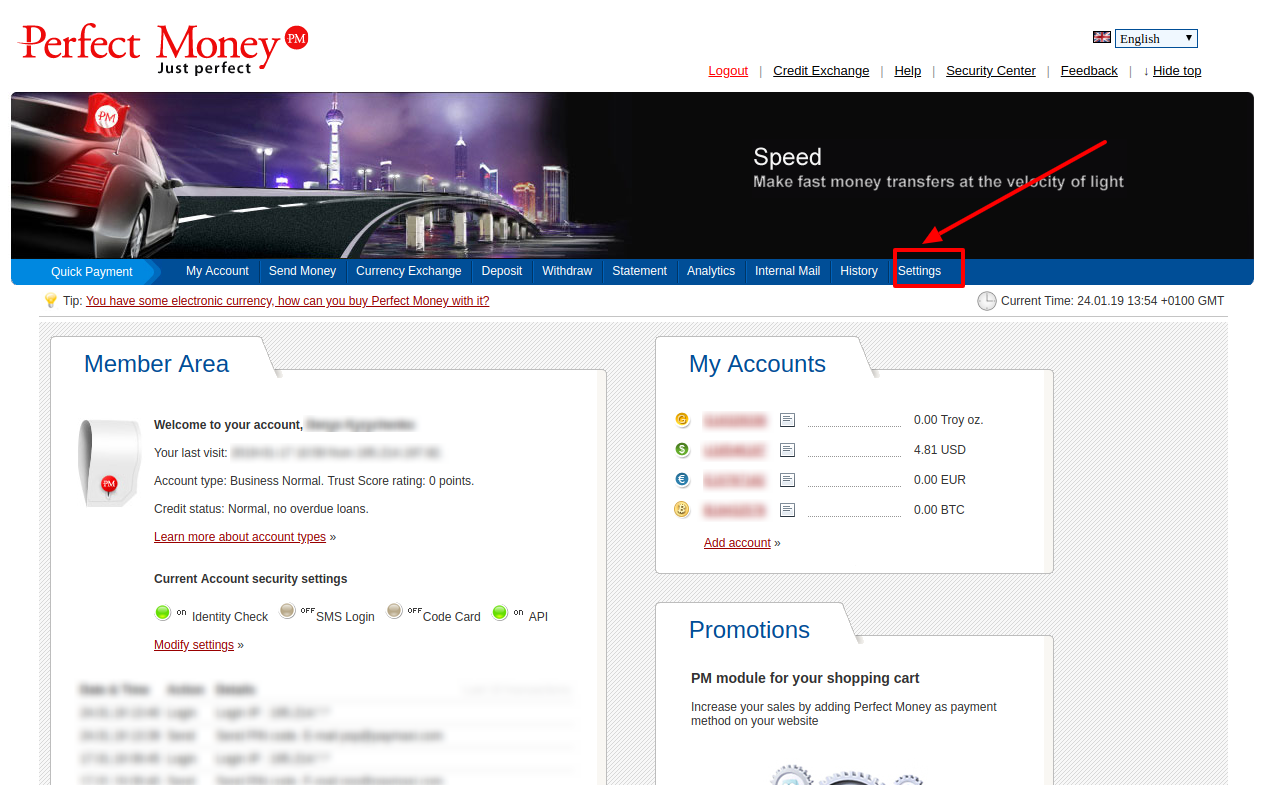

Follow these steps to open a Perfect Money account: (US and Canadian residents may visit official Perfect Money website and click the Sign Up button on the homepage for instructions.)

Look for and click the “Sign Up” or “Registration” button on the homepage, filling in your details on the Registration Form: Once on this page you must submit all required data such as Full name, Email address, Country of residency and a strong and secure password before agreeing to Terms & Conditions:

Read through and accept the terms and conditions of Perfect Money before selecting “Accept and Register”. Once completed, complete any CAPTCHAs or security verification steps necessary and click “Register”.

Once complete, click the “Register” or “Create Account” button to submit your registration and complete it.

Verifying Your Email: In some instances, Perfect Money requires that your email be verified in order for the account to function successfully. Check your inbox for an email from them with detailed instructions on how to verify it before continuing the login process for your Perfect Money account. Logging In To Your Account: In certain circumstances you may require logging on into your Perfect Money account in order to secure it properly and gain access. Ultimately Log Into Your Account & Proceed With Transactions :

Once your email has been verified, return to the Perfect Money website and log in using your new email address and password to your newly established account. Make Sure Your Security Measures Are in Place:

Increase the security of your Perfect Money account with additional measures, like two-factor authentication (2FA).

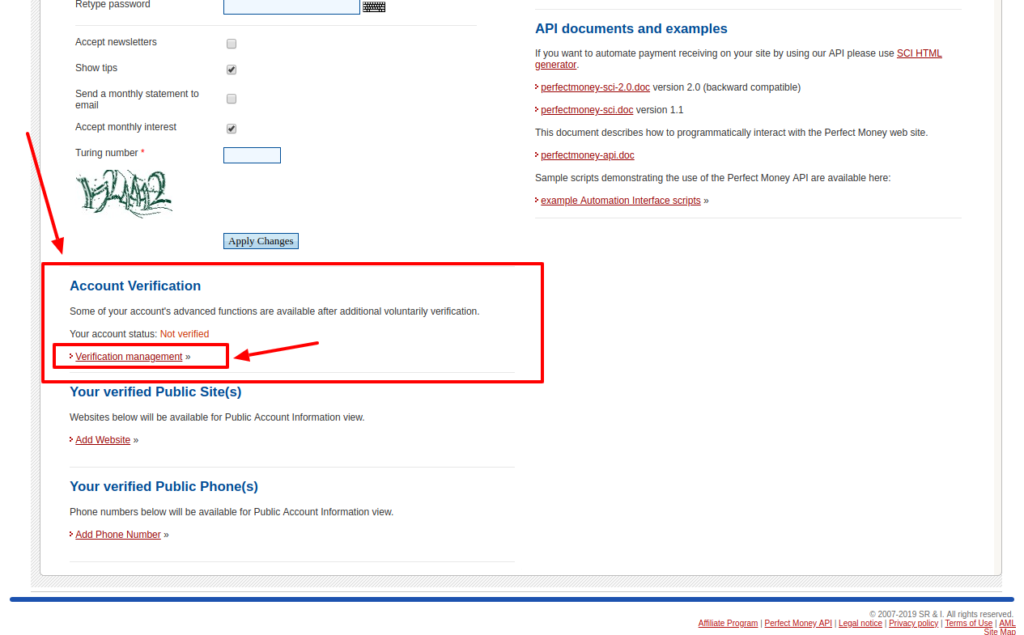

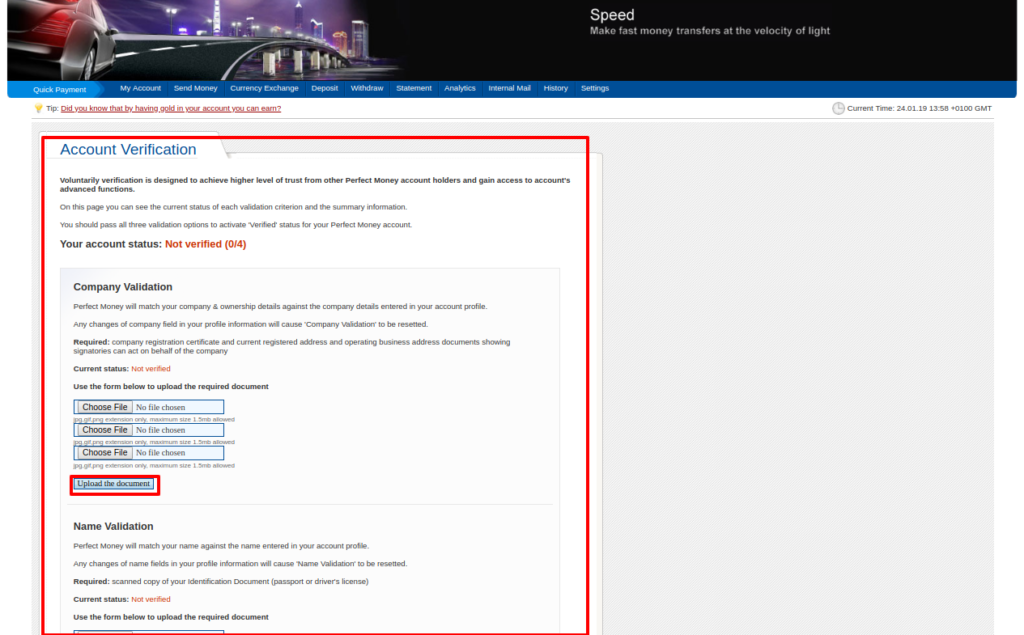

Optional Step: Depending on your account type and service usage plans, Perfect Money may require additional verification steps for additional account verification purposes. Follow any necessary instructions provided to complete any necessary verification steps.

Pros and Cons of Perfect Money Account

Pros of Perfect Money:

Global Transactions: Perfect Money allows users to conduct global transactions, providing seamless international money transfers.

Currency Options: Individuals and businesses operating across various regions have access to multiple currency options that enable quick, efficient transactions.

Instant Transactions: Our platform facilitates instant money transfers that provide quick money transfers between accounts instantly.

Perfect Money has many security features in place to safeguard users against unwarranted access and provide peace of mind for them as users access Perfect Money services. Two-factor authentication and account verification provide additional layers of defense from potential unauthorised use of Perfect Money accounts.

Privacy: Users of Perfect Money can conduct their transactions with some level of discretion as it doesn’t always require divulgence of sensitive personal data.

Perfect Money offers currency exchange services that allow users to convert between currencies within its platform, while offering convenient prepaid card links linked with Perfect Money accounts so users can spend funds online or offline.

Perfect Money can be used for online shopping and payments, making it versatile enough to handle various financial transactions. In addition, its 24/7 availability provides users with easy financial management and transactions whenever it suits them best.

Cons of Perfect Money:

Limited Acceptance: Payment methods such as Perfect Money are less accepted among merchants and businesses compared with more mainstream options; finding merchants accepting Perfect Money may prove challenging compared to more mainstream methods of payment.

Regulatory Risks: The regulatory environment surrounding online financial services can be volatile and uncertain, which requires users to remain cognizant of changes to both local laws and regulations which could influence how Perfect Money can be utilised by their region.

Scam Risk: Like other online financial platforms, Perfect Money users should exercise extreme caution when engaging with unfamiliar parties – particularly scammers and fraudulent schemes that use its system to commit scams and schemes of various forms.

Fees: Perfect Money may charge fees for certain transactions and the fee structure can be complicated, so users should carefully study it in order to fully comprehend all associated expenses using its platform.

Customer Support: Some users have reported issues with customer support, including delays and difficulty in resolving problems.

Verification Process: Depending on your account type and services used with Perfect Money, verification procedures could take significant time before being complete.

Volatility: Currencies held within Perfect Money accounts may experience considerable fluctuations, which may jeopardise their overall value and require regular monitoring to protect funds against this possibility.

Before choosing Perfect Money as their money platform of choice, individuals should carefully weigh its potential advantages and disadvantages, conduct extensive research, and determine whether its features meet their financial requirements and preferences.

FAQ of Perfect Money

Here are some of the frequently asked questions about Perfect Money:

-

What is Perfect Money?

Perfect Money is an online payment system that was founded in 2007. It allows users to make secure online payments, exchange currencies, and purchase goods and services. Perfect Money is available in over 200 countries and territories.

-

How do I create a Perfect Money account?

To create a Perfect Money account, you will need to go to the Perfect Money website and click on the “Create Account” button. You will then need to provide some basic information, such as your name, email address, and password. Once you have created an account, you will need to verify your email address.

-

How do I deposit funds into my Perfect Money account?

There are a few different ways to deposit funds into your Perfect Money account. You can deposit funds using a credit or debit card, a bank transfer, or a cryptocurrency.

-

How do I withdraw funds from my Perfect Money account?

There are a few different ways to withdraw funds from your Perfect Money account. You can withdraw funds using a credit or debit card, a bank transfer, or a cryptocurrency.

-

What are the fees for using Perfect Money account?

There are a few different fees associated with using Perfect Money. These fees vary depending on the type of transaction you are making. For example, there is a fee for depositing funds using a credit or debit card. There is also a fee for withdrawing funds using a bank transfer.

-

Is Perfect Money account safe?

Perfect Money is a secure payment system that uses a variety of security measures to protect user accounts and funds.

-

Is Perfect Money account legal?

Perfect Money is a legal payment system that is regulated by the government of the Seychelles. However, it is important to note that Perfect Money is not available in all countries.

-

How do I contact Perfect Money support?

If you have any questions about Perfect Money, you can contact their support team by email or live chat. You can find their contact information on the Perfect Money website.

I hope this answers your questions about Perfect Money account. Please let me know if you have any other questions.

Conclusion

Perfect Money is a digital payment system that allows users to make online transactions, including sending and receiving money, buying goods and services, and exchanging currencies. It was launched in 2007 and is based in Panama.

One of the main features of Perfect Money is its ability to support multiple currencies, including USD, EUR, and gold. It also provides various security measures, such as two-factor authentication, SSL encryption, and PIN protection.

Perfect Money has been used by individuals and businesses around the world, particularly in countries where traditional banking systems are limited or unreliable. However, it has also been associated with fraudulent activities and has faced criticism for its lack of transparency and regulation.

In conclusion, while Perfect Money offers some advantages for online transactions, users should exercise caution and thoroughly research the system before using it. It is important to be aware of the potential risks and to consider using other, more established payment systems with stronger regulatory oversight.

Reviews

There are no reviews yet.